Why Dental Supply Tariffs and Price Negotiation Matter More Than Ever in 2025

Dental Supply Tariffs and Price Negotiation have become critical survival skills for practice owners in 2025. Here's what you need to know right now:

Key Tariff Facts:

- 10% baseline tariff on all imports as of April 2025

- Up to 54% tariffs on dental implants and prosthetics from China and Mexico

- 69% of dental devices sold in the U.S. are imported

- 15-25% duties on zirconia blocks, burs, and handpieces from Chinese manufacturers

Your Action Plan:

- Set a supply budget at 4-5% of monthly collections

- Consolidate orders to negotiate better terms

- Diversify suppliers to reduce single-source dependence

- Build relationships with sales reps who can flag pricing changes early

The numbers tell a stark story. One Vancouver clinic reported that suggested fees have doubled in the last ten years due to rising material costs. Private practices with limited purchasing power are receiving price increase notices from vendors right now.

The reality is simple: tariffs aren't going away, and practices that wait to adapt will watch their margins evaporate.

I'm Adam Schuh, President and CEO of Clinical Supply Company. We've spent years developing tariff-resilient pricing models to protect practices from market volatility. This guide will show you how to protect your practice's bottom line while maintaining the quality of care your patients expect.

The 2025 Tariff Landscape: What Your Practice Needs to Know

The 2025 tariff landscape has shifted how we do business. In April, the U.S. administration rolled out a 10% baseline tariff on all imports, but that's just the starting point. Dental implants and prosthetics from China and Mexico now face tariffs up to 54%. This is compounded by retaliatory tariffs from trade partners, creating a complex web affecting everything from consumables to high-tech equipment.

The American Dental Association recognized this threat, joining a coalition to oppose the tariffs. The ADA voiced concerns over disrupted supply chains, skyrocketing costs, and mounting financial pressure on providers. The ultimate worry is that these costs will lead to longer wait times and reduced access to care for patients.

Most Impacted Dental Products and Categories

Our industry is uniquely vulnerable, as 69% of medical and dental devices sold in the U.S. are imported. This exposes most daily-use items to tariff fluctuations.

Key categories impacted include:

- Dental implants and prosthetics: Tariffs up to 54% on products from China and Mexico are driving up restorative costs.

- Zirconia blocks, burs, and handpieces: Items from Chinese manufacturers like Envista and Aidite face 15-25% duties.

- Gloves and masks: These critical consumables are key risk areas for pricing pressure.

- Imaging systems and scanners: Equipment from Europe and Asia has seen significant price jumps. Even items like dental floss have been targeted by retaliatory tariffs.

A clear pattern is emerging. High-volume, low-margin imports like generic handpieces are most at risk due to their slim margins and Chinese sourcing. Conversely, premium products from U.S. and European manufacturers—such as premium clear aligners and CBCT systems—have more protection due to domestic sourcing and strong brand loyalty.

The Ripple Effect on Operational Costs and Patient Accessibility

These tariffs directly translate into increased operational expenses, squeezing profit margins and making it harder to invest in technology or staff. Hitting the recommended supply budget of 4-5% of last month's collections is now a significant challenge.

The impact extends to your patients. Rising costs force a difficult choice: absorb the increases or raise patient fees, potentially pricing people out of necessary care. This can lead to delayed treatments and bigger health problems down the road. Strategic Dental Supply Tariffs and Price Negotiation is crucial to control costs without compromising quality, protecting both your practice and your patients. Optimizing costs in all areas, such as managing cleaning supply costs, can help offset these tariff pressures.

Mastering Dental Supply Tariffs and Price Negotiation: Proactive Strategies

Practices that thrive in this environment are taking action today. This means getting strategic about cost mitigation, supplier diversification, technology adoption, and financial planning. A proactive approach to Dental Supply Tariffs and Price Negotiation builds resilience into your procurement strategy.

Effective Dental Supply Tariffs and Price Negotiation in a Volatile Market

- Build genuine supplier relationships: Your sales rep should be a partner. At Clinical Supply Company, our reps are advocates who understand your practice and can proactively discuss alternatives when tariffs hit. This is the value of a dedicated sales representative.

- Consolidate your orders: Establishing a consistent ordering rhythm (e.g., twice monthly) eliminates nuisance fees for small or rushed orders charged by large distributors like Henry Schein. Predictability makes you a more valuable customer, leading to better pricing.

- Ask for pricing outlooks: Proactively ask your sales rep about upcoming price changes and potential alternatives. A responsive partner like Clinical Supply Company tracks these changes daily and will have answers ready.

- Explore alternative products: Be open to clinically equivalent alternatives for items like gloves or burs. We continuously vet high-quality options to help you save money when your usual products become tariff casualties.

- Leverage buying power: Even as an independent practice, you gain leverage by concentrating purchases. At Clinical Supply Company, we treat every practice as a valued partner, using our collective volume to negotiate better terms with manufacturers and passing the savings to you.

Financial Planning for Dental Supply Tariffs and Price Negotiation

- Set a clear supply budget: A budget of 4-5% of last month's collections is essential. Make it a team goal to foster a culture of cost control.

- Use ordering platforms for budget control: Our online platform provides real-time spending visibility, alerts, and usage patterns, giving you far more control than calling in orders. For more guidance, see our tips for smart online purchasing.

- Audit spending regularly: Quarterly reviews of purchasing patterns can reveal overstocking, unexpected usage, or quiet price creep, uncovering significant savings opportunities.

- Manage cash flow: Maintain an operating reserve and review payment terms to manage unpredictable cost spikes from tariffs.

The Role of Technology and Supply Chain Diversification

- Adopt digital dentistry: Tools like CAD/CAM systems and 3D printing reduce reliance on imported lab work and supplies, bypassing associated tariffs. The upfront investment can pay for itself through reduced costs and faster turnaround.

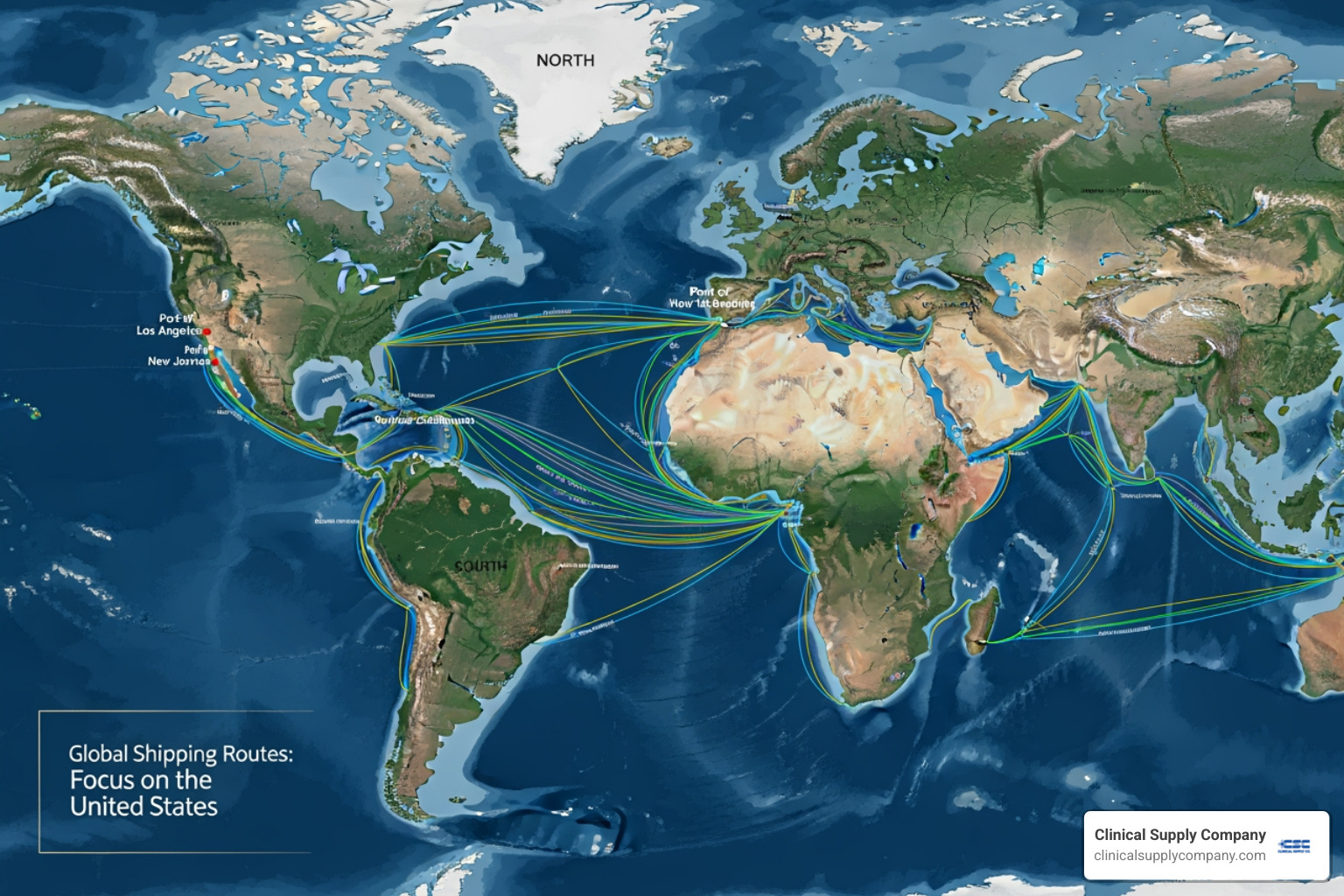

- Diversify your supply chain: Never rely on a single source for critical supplies. At Clinical Supply Company, we've built a diverse supplier network to protect our customers. When one country's products are hit with tariffs, we have alternatives ready.

- Source strategically: We are transparent about country of origin, allowing you to choose US-based manufacturers or avoid products from high-tariff countries. Our agility lets us pivot to better-priced alternatives, unlike large distributors locked into specific contracts.

- Maintain safety stock: Keep a reasonable cushion of high-use, tariff-vulnerable items like gloves and masks. Our guide on stocking up on essential supplies shows how to do this without overcommitting your budget.

How Tariffs Affect Different Practice Models

The impact of Dental Supply Tariffs and Price Negotiation is not felt uniformly across the dental industry. The structure and size of your practice plays a significant role in how quickly and severely these cost increases hit your bottom line.

| Feature | Independent Practices / Small Groups | DSO-Affiliated Practices / Large Groups |

|---|---|---|

| Purchasing Power | Limited, individual practice volume. | High, aggregated volume across multiple locations. |

| Negotiation | Direct, often less leverage. | Centralized, strong leverage with suppliers. |

| Cost Absorption | Directly absorbs increases, impacting profit margins immediately. | Can absorb or mitigate through scale, potentially slower impact on individual clinics. |

| Price Increases | Receives increases from select vendors sooner and more directly. | Better positioned to negotiate, shift purchasing, or insulate against price increases through scale advantages. |

| Supply Chain | More susceptible to single-supplier disruptions. | Diversified and managed centrally, greater resilience. |

| Technology | Investment decisions made individually, slower adoption. | Centralized technology adoption, potentially leveraging better pricing. |

Independent Practices vs. DSO-Affiliated Groups

Independent and small group practices often feel the squeeze of tariffs more acutely. With limited buying power, they face greater exposure to price hikes and have fewer options when a vendor increases costs.

In contrast, Dental Support Organizations (DSOs) use their aggregated purchasing volume to negotiate better terms and insulate their clinics from the immediate shock of price increases. This scale advantage creates a buffer that independent practices lack.

While large distributors like Henry Schein offer scale, we've heard from practices that this can mean slower price adjustments and less personal service. When you need to pivot quickly, getting lost in a corporate bureaucracy isn't helpful.

At Clinical Supply Company, we offer a different solution. We combine the personal touch of a Midwest-based company with competitive pricing that rivals the big distributors. We act as a dedicated partner, ensuring every practice, regardless of size, receives the attention and value they deserve.

The Role of GPOs and Buying Clubs

Group Purchasing Organizations (GPOs) and buying clubs offer a way for independent practices to gain leverage. By aggregating the purchasing power of many smaller practices, they help secure volume discounts that would be impossible to negotiate alone. Programs like the Carabelli Club are designed to help private practice owners cut costs across supplies, labs, and technology.

At Clinical Supply Company, we provide competitive pricing directly, eliminating the need for a middleman. Our goal is to be more than just gloves: a comprehensive supply partner who empowers practices of all sizes to manage costs effectively. We offer access to the supplies you need at prices that protect your margins—no membership fees required, just an honest partnership.

Market Response and Future Outlook

The dental supply market is a dynamic ecosystem, and tariffs have forced suppliers and manufacturers to adapt rapidly. Understanding their strategies and the broader market outlook is key to successful Dental Supply Tariffs and Price Negotiation for your practice.

How Suppliers and Manufacturers are Adapting

Manufacturers and suppliers are adapting to the 2025 tariff landscape in several ways. While some initially tried absorbing costs, this is rarely a long-term solution. The more common reality is passing costs to consumers, with increases moving down the supply chain to dental practices.

We're also seeing a significant trend of shifting production and reshoring. Companies are moving production to non-tariff countries or back to the U.S. This gives an advantage to companies with established U.S. manufacturing like Dentsply Sirona, while pressuring those like Envista and Aidite that rely on Chinese manufacturing. In response, many suppliers are highlighting country of origin to help practices make informed decisions.

Major distributors are also reacting. Henry Schein aims to leverage its scale to minimize price adjustments, but this can lead to slower responsiveness and less personal service. Benco Dental has been direct about passing on costs, placing the burden on customers to navigate the price changes.

At Clinical Supply Company, our Midwest values drive a different approach. We develop tariff-resilient pricing models, staying nimble to adapt to market volatility. We offer the personalized service needed to find alternatives confidently, focusing on transparent pricing and value over sheer corporate scale.

The Near-Future of Dental Supply Costs

Dental supply costs will likely remain volatile, with analysts projecting 0.8-1.2% of margin pressure for companies reliant on Chinese goods. With tariff relief unlikely before late 2026, practices must prepare for a prolonged challenge.

A temporary U.S.-China deal in mid-2025 offered a brief 90-day tariff pause, but it did not signal a permanent end to trade concerns. The broader policy landscape suggests ongoing shifts, making supply chain agility and resilience essential survival skills. The situation is further complicated by potential U.S.-Canada trade disputes that could impact the entire North American market.

Building a resilient supply chain is essential for survival. We are committed to being your partner in this challenge, constantly monitoring trade developments and sourcing options to protect your bottom line. We are actively shaping 2025 by adapting our strategies to deliver the best value and service. The path forward requires vigilance, flexibility, and a supply partner invested in your success.

Frequently Asked Questions about Dental Supply Tariffs

Navigating the complexities of Dental Supply Tariffs and Price Negotiation can feel overwhelming. Here, we're answering the questions we hear most often from dental professionals with straightforward, usable advice.

How can my small, independent practice negotiate prices like a large DSO?

You have more leverage than you think. Instead of trying to match DSO volume, focus on these strategies:

- Build strong relationships: Work with a sales representative who acts as your advocate. At Clinical Supply Company, our reps know your practice and proactively alert you to pricing changes and opportunities, a level of personal service larger distributors often can't match.

- Consolidate your ordering: Increase your value to a supplier by consolidating your purchases. This gives you negotiating power for better terms and loyalty discounts.

- Trial alternative products: The best negotiation is often finding a high-quality, clinically equivalent alternative that costs less. We continuously vet such products so you can save without compromising quality.

Are tariffs a short-term problem or a long-term reality?

The honest answer is that this is a long-term reality. While specific rates may fluctuate, as seen with the temporary 90-day pause in mid-2025, the broader focus on trade policy is a fundamental shift. Industry analysis suggests tariff relief is unlikely before late 2026. This means Dental Supply Tariffs and Price Negotiation must be integrated into your operational planning as the new normal, not treated as a temporary inconvenience.

Besides raising my fees, how can I protect my practice's profitability?

Passing every cost increase to patients is a short-sighted strategy. Protect your profitability with smarter approaches:

- Implement a strict 4-5% supply budget: Base it on last month's collections and make it a team goal. This discipline forces intentional purchasing and reduces waste.

- Conduct regular spending audits: Review purchasing patterns to identify inefficiencies like over-ordering or price creep.

- Leverage technology: Digital tools like CAD/CAM systems reduce reliance on external labs and tariff-affected imports.

- Work with a proactive supply partner: A partner who identifies cost-saving opportunities is invaluable. At Clinical Supply Company, our reps monitor your usage and suggest alternatives before price increases hit your account. This proactive partnership is rooted in our Midwest values of genuine service. For more tips, see our article on what to consider when buying dental supplies online.

Conclusion: Building a Tariff-Proof Practice

Dental Supply Tariffs and Price Negotiation don't have to spell disaster for your practice. While the 2025 landscape is challenging, you are not powerless. Proactive practices will thrive by understanding product vulnerabilities, building strong supplier relationships, sticking to a 4-5% supply budget, and embracing alternatives. The key principles are diversification, relationship-building, technology adoption, and precise financial planning. These are the tools to protect your profitability without passing every cost to your patients.

At Clinical Supply Company, we are more than just a vendor. As a Midwest-based national dental supply company, we bring values of honesty and genuine care to every interaction. We are your partner in navigating these uncertain times, offering the agility and personal touch that larger distributors often lack. Our commitment to exceptional service means we constantly monitor the market and work to secure tariff-resilient pricing for our customers.

For more tips, read our guide on what to consider when buying dental supplies online.

Building a tariff-resilient practice is about making smart, informed decisions daily and working with a partner who understands your challenges. Together, we can build a more profitable future for your practice.

![Smile Brighter: Strategies for Seamless Dental Practice Management [Updated Dec 2025]](http://clinicalsupplycompany.com/cdn/shop/articles/0fa6b0579e40927029105c5067f1ed3080130066_{width}x.jpg?v=1764769664)